Unexpected emergencies can arise at any moment, leaving many scrambling for immediate funds. Traditional loan processes often entail endless paperwork, multiple bank visits, and long waiting periods. Fortunately, the advent of instant personal loan apps has transformed the lending industry. These digital platforms provide fast, hassle-free access to funds, enabling borrowers to navigate financial emergencies with confidence and ease.

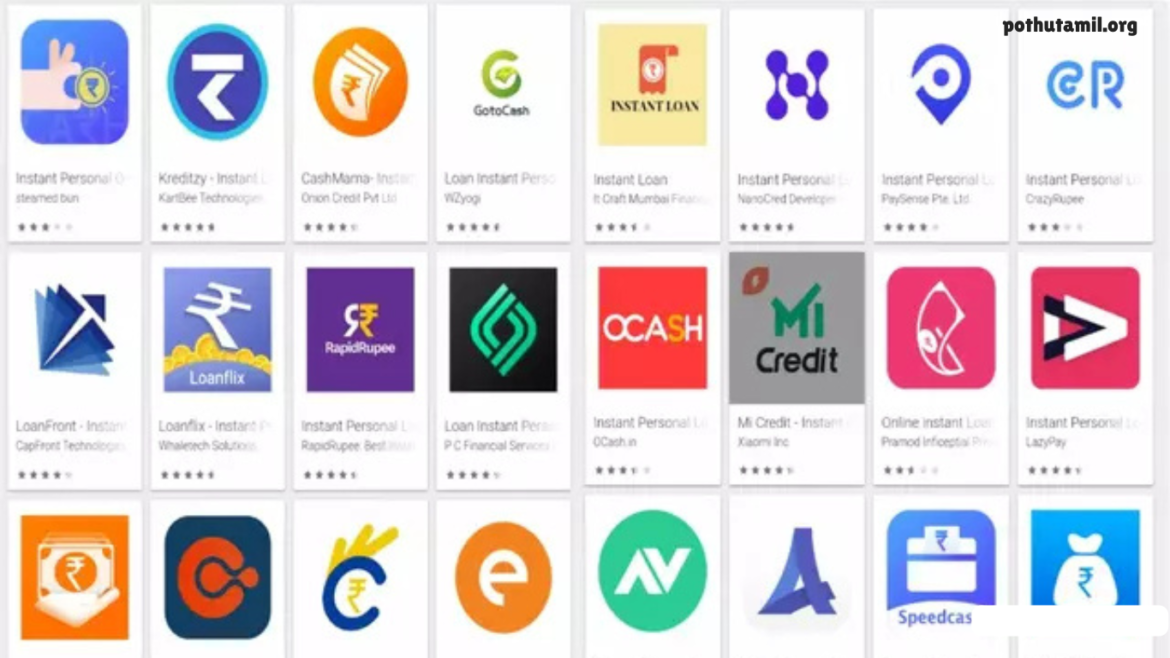

Below, we present a curated list of some of the best instant personal loan apps available in India. These apps have earned their reputation through user-friendly interfaces, rapid approval processes, minimal documentation requirements, and competitive interest rates.

Why Choose Instant Personal Loan Apps?

- Speed and Convenience: You can apply for and receive funds quickly without extensive paperwork or physical bank visits.

- User-Friendly Experience: Intuitive interfaces make the application process straightforward and accessible.

- Flexible Options: Many apps offer competitive interest rates and customizable repayment plans tailored to diverse financial needs.

- Enhanced Security: Advanced security measures ensure that your personal and financial data remain protected throughout the process.

Top Instant Personal Loan Apps in India

1. XYZ Instant Loan

XYZ Instant Loan offers a streamlined borrowing experience. It allows you to secure a personal loan within minutes from the comfort of your home. Its hassle-free application process, competitive interest rates, and flexible repayment options make it a preferred choice among many borrowers.

2. ABC Loan Express

Renowned for its lightning-fast approval process, ABC Loan Express prioritizes customer convenience. The app’s intuitive design ensures that applying for a personal loan is both simple and secure, safeguarding your sensitive information every step of the way.

3. PQR Quick Cash

PQR Quick Cash stands out for its seamless borrowing experience. With personalized loan offers and an instant disbursal feature, the app ensures that funds are transferred directly to your bank account within minutes of approval, making it an ideal solution for urgent financial needs.

4. LMN Cash Now

Recognizing the urgency of financial requirements, LMN Cash Now delivers quick and hassle-free loans through a user-centric app. Its design simplifies the loan application process, ensuring accessibility for individuals of all technical backgrounds. Robust customer support is available to assist you.

5. RST Instant Cash

Offering a diverse range of loan options, RST Instant Cash caters to various financial demands—from short-term fixes to larger expenses. With transparent terms and competitive interest rates, it serves as a reliable partner for those seeking swift financial assistance.

6. EFG Quick Loans

EFG Quick Loans is committed to delivering a smooth borrowing journey. Its intuitive interface guides you through every step—from document submission to tracking your loan status—ensuring that you receive the necessary funds swiftly and efficiently.

7. UVW Money

UVW Money simplifies the loan process by requiring minimal documentation and providing rapid approvals. Whether you need funds for medical expenses, education, or any other purpose, UVW Money offers tailored loan options with attractive rates and flexible repayment plans to help you manage your finances effectively.

8. IJK Fast Cash

IJK Fast Cash is well-known for its hassle-free application process and prompt fund disbursal. The app’s user-friendly design ensures a smooth experience, enabling borrowers to meet their financial needs without unnecessary delays or complications.

9. HIJ Quick Finance

HIJ Quick Finance delivers reliable, instant personal loans with transparent terms and competitive interest rates. Its efficient approval process and easy-to-navigate interface have made it a trusted name in the lending industry, ensuring a satisfying borrowing experience for its users.

Frequently Asked Questions

What are instant personal loan apps?

Instant personal loan apps are digital platforms that allow you to apply for and receive personal loans quickly, often within minutes, without the need for extensive paperwork or multiple bank visits.

How fast can I receive the loan amount?

Most of these apps offer rapid disbursal, with funds often transferred directly to your bank account within minutes of approval, depending on the lender’s processing time.

What documentation is typically required?

These apps generally require minimal documentation, such as proof of identity, address, and income. The streamlined process is designed to minimize paperwork and expedite the approval process.

How are interest rates determined?

Interest rates vary based on the lender’s policies, your credit profile, and market conditions. Many apps offer competitive rates along with flexible repayment options tailored to your needs.

What happens if I have a poor credit score?

Some apps may offer loans even to those with less-than-perfect credit scores, though the terms and interest rates might differ. It’s advisable to review each app’s specific requirements before applying.

Can I repay the loan early without penalties?

Repayment terms differ by lender. Many apps provide flexible repayment options, including early repayment. Be sure to check the terms and conditions of your chosen app for details.

How do I choose the right loan app for my needs?

Consider factors such as the app’s user interface, processing speed, documentation requirements, interest rates, and customer reviews. Compare these features to select the app that best aligns with your financial situation.

Conclusion

As the lending landscape continues to evolve, instant personal loan apps are emerging as a modern solution to traditional financial challenges. They empower borrowers to access funds quickly and securely, making them an indispensable tool in today’s fast-paced world. Whether facing an unexpected expense or planning for future needs, these apps offer a range of options designed to simplify and expedite the loan process.